What is the Inflation Reduction Act (IRA) Home Energy Rebate Program?

The IRA Home Energy Rebate Program is a federally funded program that offers rebates to homeowners and multifamily property owners for energy-efficient dwelling improvements. The program includes two main offerings: the Home Efficiency Rebates (HOMES) program and the Home Electrification and Appliance Rebates (HEAR) program.

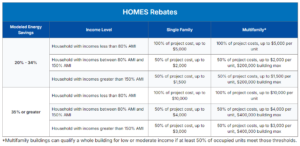

HOMES Program

The HOMES program provides rebates for energy-efficient home improvements, such as adding insulation, upgrading heating and cooling equipment, and air sealing. To participate, a home energy assessment is required, and work must be performed by an IRA registered contractor. The rebate amounts vary based on your household’s income and the anticipated energy savings from the recommended upgrades. Learn more about the HOMES Program on the Focus on Energy website here.

Already completed a home energy assessment?

Retroactive HOMES rebates are available for assessment/projects initiated on or after August 16, 2022, that meet certain requirements.

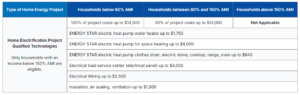

HEAR Program

The HEAR program offers rebates for households, at or below 150% of the Area Median Income, that install heat pumps and other efficient electric appliances. This program will also cover improvements like insulation, air sealing, and electrical panel and wiring upgrades. It is available to Wisconsin residents in single-family homes and multifamily buildings. Learn more about the HEAR Program on the Focus on Energy website here.

Which program is best for me?

If your home is older and in need of updates, it may be best for you to take advantage of the HOMES program. A required home energy assessment will provide you with a list of recommendations to make your home more energy efficient. Though the assessment is not free (typically $500 – $600), you may be eligible for a $500 instant discount, and you can also take advantage of a $150 Federal tax credit to help offset the cost. Once you have your assessment results, you can choose which improvements you’d like to make through the HOMES program, or you can choose to make one or more improvements through the HEAR program. Your IRA registered contractor will help guide you through the process.

If you are looking to upgrade specific equipment in your home, the HEAR program is best for you.

What if I rent my home?

You may still be eligible for IRA rebates, however, you will need to work with your landlord throughout the application and approval process.

What if I own a multifamily property?

Multifamily properties may be eligible for rebates through the HOMES program. Contact your local multifamily energy advisor for more information: Multifamily Energy Advisor Map

How do I get started?

Because IRA rebate amounts are dependent on income, it is best to start by checking your HOMES program eligibility.

You can also start by using the Focus on Energy Rebate Finder Tool. Based on the information you provide (household size and income), the tool will provide you with a list of resources, including state assistance programs, rebates from Focus on Energy, rebates from the IRA program, and Federal tax credits, that you may be eligible for.

Have questions?

You can call Focus on Energy at 800-762-7077 or send your questions to your Kaukauna Utilities Energy Services Manager at fbarth@wppienergy.org.